Insurance

Universal Life Insurance

Universal life insurance is permanent life insurance — that is, it remains in force for your whole life. But universal life insurance has an important difference from other types of permanent insurance: it provides a flexible premium.

That means the policyholder decides how much to put in above a set minimum. By extension, the policyholder also determines the face amount of the policy.

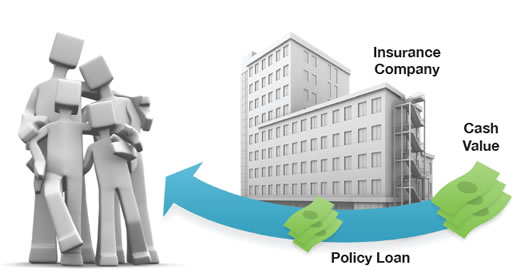

Universal life insurance policies accumulate cash value — cash value that grows tax deferred. Guarantees are based on the claims-paying ability of the issuing company.

Universal life insurance policies normally let policyholders borrow a portion of their policy’s cash value under fairly favorable terms. And interest payments on policy loans go directly back into the policy’s cash value.*

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

*Universal life insurance has certain features that make the policy suitable for some individuals. Whether universal life insurance is appropriate for you will depend on your goals, needs, and circumstances.

Accessing the cash value in your insurance policy through borrowing — or partial surrenders — has the potential to reduce the policy’s cash value and benefit. Accessing the cash value may also increase the chance that the policy will lapse and may result in a tax liability if the policy terminates before your death.

Universal life insurance can be structured so that the cash value that accumulates will eventually cover the premiums. However, additional out-of-pocket payments may be required if the policy’s dividend decreases or if investment returns underperform.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Withdrawals of earnings are fully taxable at ordinary income tax rates. If you are under age 59½ when you make the withdrawal, you may be subject to surrender charges and assessed a 10% federal income tax penalty. Also, withdrawals will reduce the benefits and value of the contract. Life insurance is not FDIC insured. It is not insured by any federal government agency or bank or savings association.

Generally, loans taken from a policy will be free of current income taxes, provided certain conditions are met, such as the policy does not lapse or mature. Keep in mind that loans and withdrawals reduce the policy’s cash value and death benefit. Loans also increase the possibility that the policy may lapse. If the policy lapses, matures, or is surrendered, the loan balance will be considered a distribution and will be taxable.

Whole Life Insurance

A Look at Whole Life Insurance

In exchange for fixed premiums, an insurance company promises to pay a set benefit when the policyholder dies, but also offers additional benefits as well. Whole life insurance policies can build up cash value — effectively a cash reserve that pays a modest rate of return, and the growth is tax-deferred. Guarantees are based on the claims-paying ability of the issuing company.

Most whole life insurance policies allow policyholders to borrow a portion of their policy’s cash value. Access to the cash value can allow you to pay for things like college expenses, a home down payment, or any other needs you may have. Interest payments on policy loans go directly back into the policy’s cash value.

When the policyholder dies, his or her beneficiaries receive the benefit from the policy. Depending on how the policy is structured, benefits may or may not be taxable.

Whether whole life insurance is the best choice for you may depend on a variety of factors, including your goals or circumstances.

When you borrow against this cash value of your policy, there are some important points to consider. Accessing the cash value of the insurance policy through borrowing — or partial surrenders — has the potential to reduce the policy’s cash value and benefit. Accessing the cash value may also increase the chance that the policy will lapse and may result in a tax liability if the policy terminates before your death.

As with all types of life insurance, several factors will affect the cost and availability of whole life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder may also pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

- Optimize Your cash value never decreases in value. And, you will receive a guaranteed return 4% + 6% dividends that you can count on, typically up to 50x more than what you would earn in a traditional savings account.

- Maximize You will earn 3 rates of return on your money from $1 to maximize your cash flow.

- Preserve Your money is protected from the market, creditors, taxes and the recapture of opportunity cost.

- Access Accessing your cash value at any time for any purpose is fast and easy. Quick-asset loans are flexible, with no specific payback period. They provide you access to the liquid capital you need while your balance continues to grow.

- Leverage Leverage your capital to take advantage of opportunities in your business and real estate, and allow your money to do more than one job at a time.

When implemented correctly by our qualified Financial consultant professional, your whole life insurance policy functions as your own personal banking system. Only 20% of your initial investment goes toward your base premium, while 80% goes directly toward maximizing your cash value.

Term Life

Is Term Life Insurance for You?

Term insurance is the simplest form of life insurance. It provides temporary life insurance protection on a limited budget. Here’s how it works:

When a policyholder buys term insurance, they buy coverage for a specific period of time and pay a specific price for that coverage.

If the policyholder dies during that time, their beneficiaries receive the benefit from the policy. If they outlive the term of the policy, it is no longer in effect. The person would have to reapply to receive any further benefit.

Unlike permanent insurance, term insurance only pays. It does not accumulate a cash value. That’s one of the reasons term insurance tends to be less expensive than permanent insurance.

Many find term life insurance useful for covering specific financial responsibilities if they were to die unexpectedly. Term life insurance is often used to provide funds to cover:

- Dependent care

- College education for dependents

- Mortgages

Would term life insurance be the best coverage for you and your family? That depends on your unique goals, needs, and circumstances. You may want to carefully examine the pros and cons of each type of life insurance before deciding what type of policy may be the best fit for you.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder also may pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Term VS Permanent

Term vs. Permanent Life Insurance

According to industry experts, most people don't have enough life insurance. The American Council of Life Insurers recently reported that average coverage equals $197,000, which is equivalent to almost 3.5 years in terms of income replacement (with the median income being $59,540 in 2024, according to the Bureau of Labor Statistics). That's only half the recommended 7-year threshold.1,2

Furthermore, 38 percent of consumers said that their households would financial trouble within six months if a wage earner died today.3

When considering life insurance, one of the most important factors to understand is the difference between term and permanent insurance. Here’s an inside look at both.

Term and Perm

Term life insurance is temporary; it provides a death benefit for a specific term, such as 10, 20, or 30 years. Unlike other types of life insurance, it does not accumulate a cash value. If the policyholder dies during that term, their beneficiaries receive the benefit from the policy. When the contract ends, so does the coverage.

This limited term leads to term life insurance’s main advantage: price. Generally, term life insurance costs less than permanent life insurance, especially if the purchaser is younger. This has the potential to free up funds for other household expenses.

Permanent insurance remains in place as long as the policyholder makes payments. In addition, permanent policies are designed to build up “cash value,” a cash reserve that accumulates with the policy. Typically, this cash reserve pays a modest rate of return. However, the policyholder has limited access to the funds.

Which Should You Choose?

Term life insurance can be designed to provide protection against upcoming expenses, such as putting children through college. Permanent life insurance, on the other hand, can be more useful for covering long-term financial needs, such as estate planning.

Many people find that they have a combination of short- and long-term needs. In such circumstances, it may be prudent to have both types: a basic level of permanent life insurance supplemented by a term policy. A review of your situation may help determine what type of life insurance is appropriate.

Several factors will affect the cost and availability of life insurance, including age, health, and the type and amount of insurance purchased. Life insurance policies have expenses, including mortality and other charges. If a policy is surrendered prematurely, the policyholder may also pay surrender charges and have income tax implications. You should consider determining whether you are insurable before implementing a strategy involving life insurance. Any guarantees associated with a policy are dependent on the ability of the issuing insurance company to continue making claim payments.

Term or Perm?

In 2022 people purchased more permanent life insurance policies than term life insurance policies. However, term policies account for approximately 71% of the face amount of the policies issued.1

Source: ACLI.gov, 2023

1. ACLI.com, 2023

2. BLS.gov, 2024

3. LIMRA.com, 2023

Final Expense

Final expense refers to the costs associated with a person’s end-of-life arrangements, including burial, funeral services, and other related expenses. Final expense insurance, also known as burial insurance or funeral insurance, is a type of life insurance policy designed specifically to cover these costs, providing financial relief to loved ones during a difficult time.

Breakdown of Final Expenses:

Funeral and Burial Costs

Funeral service fees

Casket or urn

Burial plot or cremation

Headstone or grave marker

Flowers, programs, and other ceremony-related items

Cremation Costs (if applicable)

Cremation fee

Memorial service

Urn or scattering of ashes

Transportation of the Deceased

Hearse or other transportation for the body

Transporting the body between cities or states (if required)

Funeral Home Services

Embalming or preparation of the body

Professional services provided by the funeral home staff

Viewing or visitation

Legal and Administrative Costs

Probate costs (processing the deceased’s will)

Death certificates

Executor fees (if applicable)

Medical Bills

Unpaid medical bills or expenses not covered by insurance at the time of death (especially for those who pass away in a hospital or after medical treatment)

Obituary and Memorial Costs

Publishing the obituary in newspapers or online

Memorial services, church fees, or other religious costs

Final Expense Insurance:

- Coverage Amounts: These policies typically have smaller coverage amounts (e.g., $5,000 to $25,000), specifically meant to cover the final expenses.

- Premiums: Monthly premiums are generally affordable, based on factors like age, health, and the amount of coverage chosen.

- Eligibility: Final expense insurance is usually easier to qualify for compared to traditional life insurance, with less stringent medical requirements.

Benefits of Final Expense Insurance:

- Eases Financial Burden: Helps ensure that loved ones won’t face the financial stress of paying for funeral or burial costs.

- Fixed Premiums: The premium amount often remains fixed, so it won’t increase over time.

- Simple Application Process: Policies generally have simplified underwriting, making it accessible even to individuals with health concerns.

Having a final expense insurance policy can be an important part of estate planning, offering peace of mind that end-of-life costs will be taken care of without burdening family members.

Mortgage Protection Insurance

Mortgage protection insurance (MPI) is a type of life insurance designed specifically to pay off your mortgage if you pass away before the loan is fully paid. It provides financial security to your family by ensuring that they won’t be burdened with mortgage payments after your death, helping them to stay in the home.

Key Features of Mortgage Protection Insurance:

- Pays Off the Mortgage: The primary benefit of MPI is that it pays off the remaining balance of your mortgage in the event of your death, ensuring that your family won’t have to worry about making mortgage payments.

- Decreasing Benefit: Many MPI policies are structured as decreasing term life insurance. This means that the death benefit decreases over time as you pay down your mortgage, corresponding with the balance remaining on your loan. As your mortgage balance shrinks, so does the payout.

- Premium Payments: Monthly or annual premiums are paid, similar to life insurance. These premiums are based on your mortgage amount, age, health, and policy terms.

- No Medical Exam: Unlike traditional life insurance, MPI policies often don’t require a medical exam, making it easier to qualify, particularly for individuals with health issues.

- Beneficiary is the Lender: Unlike traditional life insurance policies, where you can name any beneficiary, the beneficiary of an MPI policy is typically the mortgage lender. This means that if you pass away, the insurance company will pay the lender directly to settle the mortgage.

Advantages of Mortgage Protection Insurance:

- Guaranteed Mortgage Coverage: Your family won’t have to worry about losing their home if you pass away, as the insurance will pay off the mortgage balance.

- Easier to Qualify: MPI can be easier to qualify for, especially if you have health issues that make obtaining traditional life insurance more difficult.

- Peace of Mind: Provides peace of mind to homeowners, knowing that their loved ones will not be left with the financial burden of a mortgage.

MPI vs. Life Insurance:

- MPI is specifically focused on paying off the mortgage, while traditional life insurance can be used for any expenses, including mortgage payments, living expenses, education, and other needs.

- Life insurance policies (like term life or whole life) allow beneficiaries to receive a lump sum payout and decide how to use the funds, offering more flexibility.

Who Should Consider Mortgage Protection Insurance?

- Homeowners with families: Those who want to ensure that their family can stay in the home if they pass away.

- Those with health issues: Individuals who may not qualify for traditional life insurance may find MPI an easier option to secure mortgage coverage.

- New homeowners: People just starting with large mortgage balances who want added peace of mind that their home will be protected.

While MPI provides a specific and straightforward benefit, it's important to compare it to other forms of life insurance to determine the best protection for your mortgage and overall family financial security.

"The greatest legacy one can leave behind is to leave behind love and security, not debt."

– Anonymous

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.